maine excise tax rate

Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. This information is courtesy of Larry Grant City of Brewer Maine The same method will be used to calculate the fees to re-register the same vehicle.

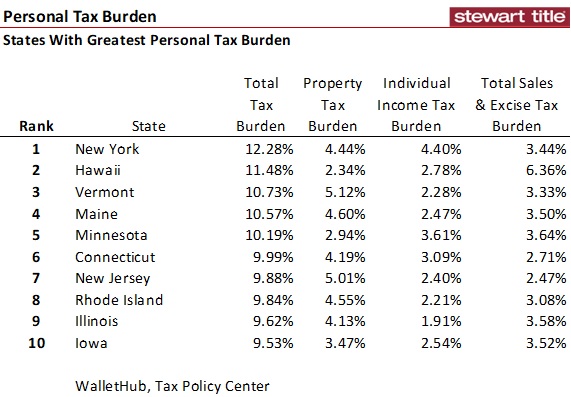

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

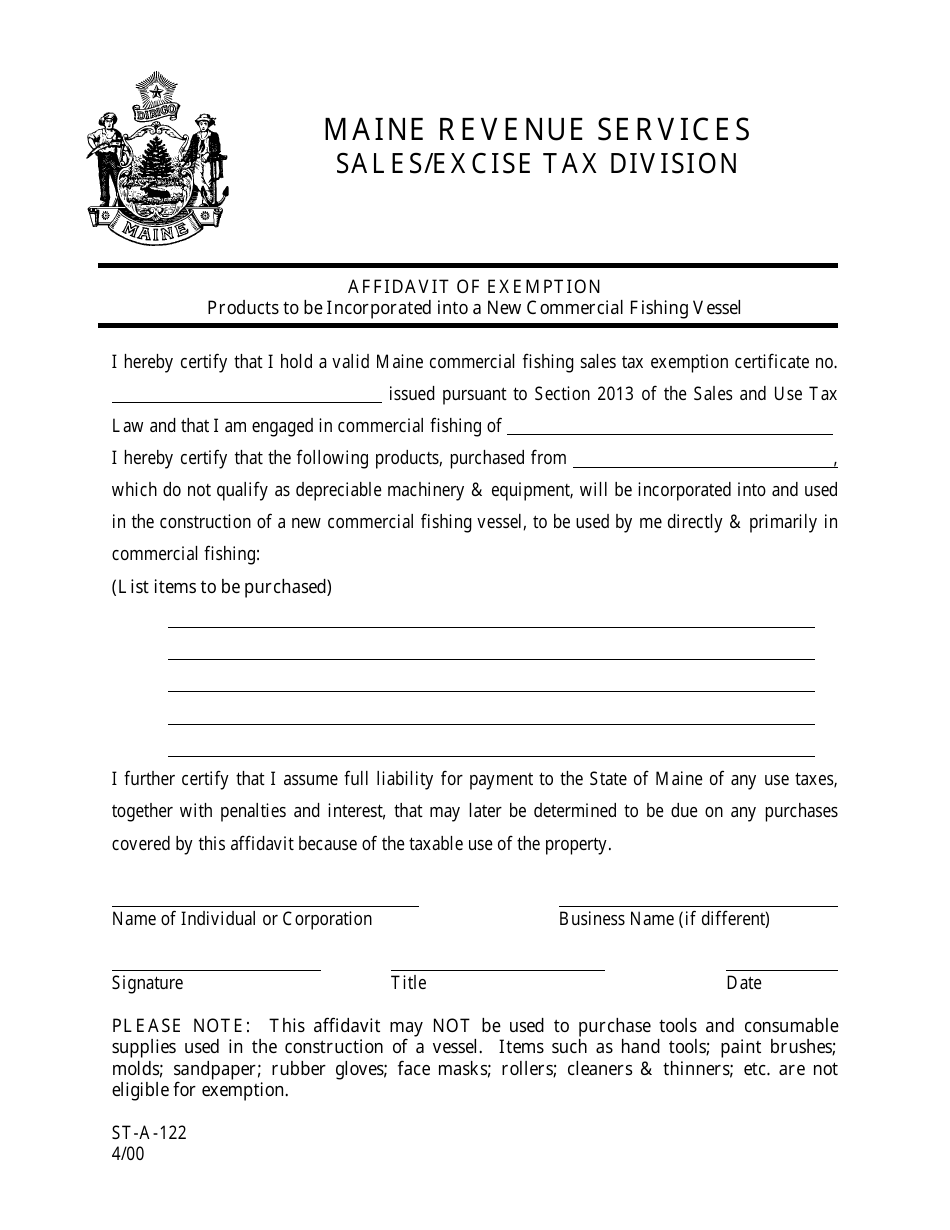

Maine Watercraft Excise Tax Law - Title 36 Chapter 112.

. Please note this is only for estimation purposes -- the exact cost will be determined by the city when you register your vehicle. This calculator is for the renewal registrations of passenger. The excise tax due will be 61080 A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle.

Mil rate is the rate used to calculate excise tax. The MSRP is the Manufacturers Suggested Retail Price of your vehicle. 18 rows The Commercial Forestry Excise Tax CFET is imposed on owners of more than.

The rates drop back on January 1st each year. The MSRP is the sticker price and. YEAR 1 0240 mill rate.

The excise tax you pay goes to the construction and repair of roadways in the state. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown below. Share this Page How much will it cost to renew my registration.

Maine imposes excise taxes on various forms of marijuana being transferred between licensees in the state such as cultivators dispensaries and wholesalers. The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehicle. Town of Eliot 1333 State Road Eliot Maine 03903 207 439-1813.

Maintaining your vehicle is important if you want to save time and money. Select the year of your vehicle and click on the Prices tab. Under Used Cars select the make and model of your vehicle and click Go.

WATERCRAFT EXCISE TAX RATES Commercial Tax 300 300 Tax 300 Tax 350 Tax 500 650 1000 Tax 550 700 1050 Tax 650 800 1150 Tax 750 900 1250 Tax 900 1050 1400 Tax. 19500 X 0135 26325 Where does the tax go. Mil rate is the rate used to calculate excise tax.

The Maine Income Tax Maine collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Our office is also staffed to administer and oversee the property tax administration in the unorganized territory. For example a 3 year old car with an MSRP of 19500 would pay 26325.

Groceries and prescription drugs are exempt from the Maine sales tax. - NO COMMA For new vehicles this will be the amount on the dealers sticker not the amount you paid. Local tax rates in Maine range from 550 making the sales tax range in Maine 550.

YEAR 1 0240 mil rate YEAR 2 0175 mil rate YEAR 3 0135 mil rate YEAR 4 0100 mil rate YEAR 5 0065 mil rate YEAR 6 0040 mil rate Step 3 Multiply your vehicles MSRP by the appropriate mil rate. Even with the savings on maintenance costs you still need to account for the annual. To calculate your estimated registration renewal cost you will need the following information.

Counties and cities are not allowed to collect local sales taxes. Navigate to MSN Autos. 6 year 0040 mil rate If a town did not collect excise tax then they would be forced to increase other taxes in order to make up the difference.

Youll be taken to a page for all years of the particular vehicle. 16 rows Effective July 1 2009 the full gasoline excise tax rate is imposed on internal. Like the Federal Income Tax Maines income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle. Enter your vehicle cost. Youll see a chart showing the MSRP of your vehicle in various trim packages.

How do I calculate excise tax. The Maine State Statutes regarding excise tax can be found in Title 36 Section. Immature plants and seedlings will also be taxed at the rate of 150.

These rates apply to the tax bills that were mailed in August 2021 and due October 1 2021. The town that collects the excise tax can use it as revenue towards the annual town budget. 2 2020 -- 1350 per 1000 of value.

Maine calculates this tax by taking the current MSRP of your vehicle and multiplying it by the mileage rate. Watercraft Excise Tax Payment Form - 2022. 2022 Maine state sales tax.

Rates for years 1990 through 2020 MS Excel Rates for years 1990 through 2020 PDF. Cultivators will pay a 335 per pound excise tax on flowers and mature plants and a 94 per pound tax on trim. 13 rows Tax Rates Maine Revenue Services Tax Rates The following is a list of individual tax rates applied to property located in the unorganized territory.

Exact tax amount may vary for different items. Departments Treasury Motor Vehicles Excise Tax Calculator. As of August 2014 mil rates are as follows.

The Maine state sales tax rate is 55 and the average ME sales tax after local surtaxes is 55.

Maine Cigarette And Tobacco Taxes For 2022

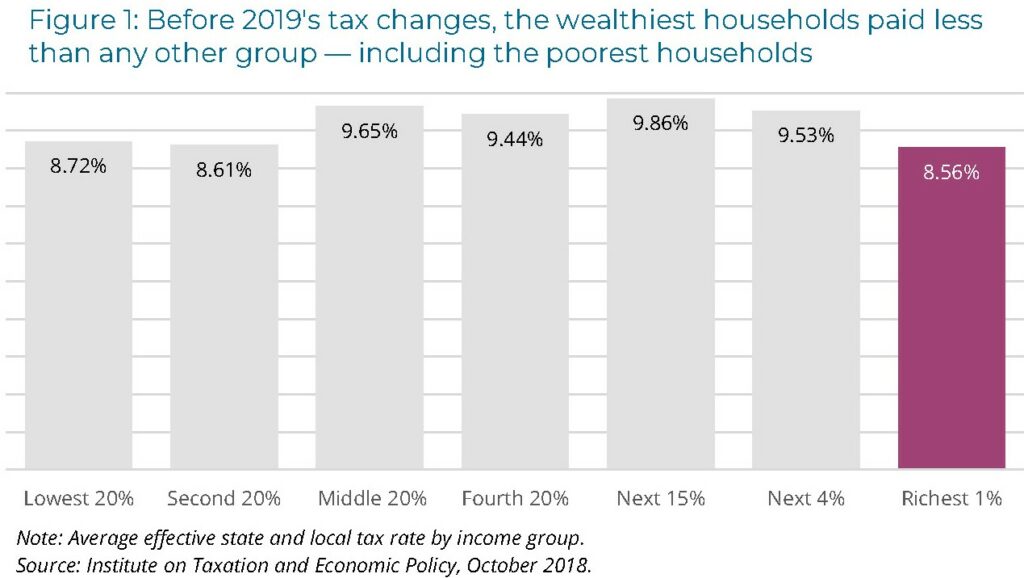

Maine Reaches Tax Fairness Milestone Itep

Historical Maine Tax Policy Information Ballotpedia

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State Alcohol Excise Tax Rates Tax Policy Center

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

Maine Car Registration A Helpful Illustrative Guide

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Maine Who Pays 6th Edition Itep

Figure 10 State Cigarette Excise Tax Rates By Pack In 201 Flickr

Maine Car Registration A Helpful Illustrative Guide

Maine S Governor Proposes To Replace The Income Tax With A Broader Sales Tax Tax Foundation

File State And Local Taxes Per Capita By Type Png Wikipedia

Maine Reaches Tax Fairness Milestone Itep

Form St A 122 Download Printable Pdf Or Fill Online Affidavit Of Exemption Products To Be Incorporated Into A New Commercial Fishing Vessel Maine Templateroller

State Corporate Income Tax Rates And Brackets Tax Foundation